Digital Battlegrounds: How New Media And Technology Are Shaping U.S. Elections

New post-election research commissioned by the Center for Campaign Innovation and conducted by David Kanevsky of 3D Strategic Research sheds light on an American electorate that is bombarded for attention, consumes politics as entertainment, experiences campaigns on a national level, and wants elected officials to be more authentic and engaging.

Expanding on our success from 2020, Campaign Innovation surveyed more than 4,000 voters both nationally and in key battleground states and districts and conducted qualitative research groups to understand how conservative activists in the U.S. consume media, engage with candidates for public office, and make decisions about politics.

Additional reports, data, and analysis are forthcoming, but this report includes initial highlights and trends.

Media Consumption & Advertising

Voters’ media habits have shifted since 2020, but candidates and their campaigns have mostly kept pace in reaching their targeted voters with paid advertising.

Post-COVID, Voters Are Consuming Less Media

Compared to 2020, voters watching local TV news daily declined from 56% to 46% (-10%), voters getting political news from social media daily went from 37% to 28% (-9%), and daily Facebook usage generally went from 60% to 52% (-8%).

The only platform we saw statistically significant growth in usage was TikTok which went from 7% weekly usage in 2020 to 11% weekly usage this year. However, TikTok is just in 5th place in terms of daily online platform usage among voters.

Voters Keep Cutting The Cord

Nationally, 29% of voters are cord cutters, compared to just 23% in 2020 (+6%). With respect to advertising reach, 39% of voters can be reached only via traditional linear TV ads while 21% can only be reached via streaming. 25% can be reached via both. 7% of voters are unreachable via TV or streaming advertising.

Nationally, Independents are the most likely to be streaming only or unreachable (32% total). Digital advertising’s importance will only grow in 2024 and beyond as just 23% of voters under the age of 50 nationally are reachable via linear TV advertising alone.

Just 23% of voters under the age of 50 are reachable via linear TV advertising alone.

Republican Messages Reached Voters, But Were Overshadowed By Other Issues

Tactically speaking, Republicans’ media campaigns effectively reached voters and delivered key messages, but were not enough to persuade voters to vote for Republican candidates over Democrats. In Nevada, 68% said Senator Catherine Cortez Masto was a liberal and 55% rated her as more liberal than themselves. In Pennsylvania, 79% of respondents said John Fetterman was a liberal (including 55% who said he was very liberal), and 58% rated Fetterman as more liberal than themselves.

Similarly, Laxalt and Oz were both seen as being the better candidates on the economy by +9% and +2% respectively. Despite the economy being the top issue nationally in the network exit polls and Republican candidates winning on who was better on the economy, Republicans underperformed because they failed to “finish their sentence” of connecting with voters on caring about them or being problem solvers and getting things done.

While voters believed the Democratic candidates were out of step both ideologically and on the issues of the economy, voters stuck with the Democrats because the Republican candidates were seen as too extreme and failed to show they were an independent voice and separate themselves from former President Donald Trump (who was more unpopular than President Joe Biden in both states and nationally).

The network exit polls reinforce this as they show the biggest swings came from voters who “somewhat disapprove” of President Biden. Those Biden "somewhat disapprovers" backed traditional Republicans like Governor-elect Joe Lombardo, Governors Brian Kemp and Chris Sununu, and Senator Ron Johnson, but did notvote for candidates who primarily identified themselves as allies of Trump in the primaries and general elections.

Engagement

Our data shows that voters primarily engage with politics via online platforms establishing the internet as a key battleground. This further heralds the need for candidates and political organizations to fundamentally integrate digital communication into every facet of their operations.

Digital Voter Engagement Increased

Even as traditional engagement via local TV news and other platforms declined nationally, digital engagement increased as 49% of voters searched online for information about a candidate (+5% over 2020), 27% visited a campaign website (+7%), and 9% participated in a livestream event with a candidate (+4%). Digital scales better for candidates as nationally 21% report interacting with a candidate’s social media presence compared to just 14% who report personally meeting or speaking to a candidate.

Opt-In Campaigning Channels Have Significant Room To Grow

Among voters nationally, 23% have opted in to campaigns’ lists via email (19%) or text (18%), including 14% who have opted in for both. Among donors, 55% report opting-in for communication via text or email.

Our survey identified another 13% of voters nationally who would consider opting in. The most important thing campaigns could do to overcome hesitation on opting in is not asking for money and making sure personal information would not be sold or shared without permission.

Fundraising

Since the early days of digital campaigning, online fundraising has been a central focus for campaigns and political organizations. Practitioners have long warned about a “tragedy of the commons” problem as more candidates turn to online fundraising and overuse common fundraising tactics.

Republicans Are Narrowing The Donor Gap

80% of donors to candidates and political organizations this cycle reported previously donating in prior years. The donors surveyed were evenly split between giving to Republicans (50%) and Democrats (49%). In 2020, that was a 32% Republican – 62% Democrat split.

In 2022, donors were giving more by every metric: more often, to more candidates, and in greater amounts.

Just 8% of voters said they gave in 2020 but did not give this cycle, primarily citing economic/inflationary reasons and lack of inspiring candidates.

Republicans Are Burnt Out By Fundraising Volume And Tactics

Across the board in our surveys and focus groups, Republican activists complained about how many fundraising emails they received soliciting money and expressed incredulity at the tactics like matching, urgency, and tone.

Instead, they’d like to receive meaningful updates, candidates’ perspectives on current events and policies, and details about how donations will be used.

Fundraising IS Voter Contact And Must Be Regarded As Such

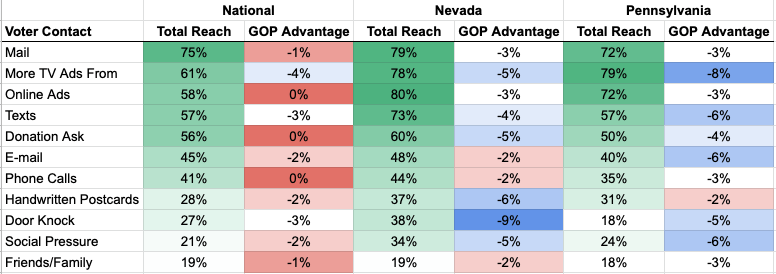

Since digital has lowered the cost of donor acquisition compared to direct mail and events, combined with a shift in voters focusing more on national political figures than their local candidates, a majority of voters now report getting fundraising solicitations from political candidates. Both nationally and in Pennsylvania and Nevada, more voters reported receiving fundraising solicitations than phone calls or door knocks. In fact, nationally, getting solicited for a donation is the 5th most common form of voter contact, right behind digital ads (58%) and text messages (57%). Therefore, the messaging that candidates and their allies use in fundraising copy should also have an eye towards voter contact.

Nationally, Republicans and Democrats were close to parity in most forms of voter contact, but Democrats had key tactical advantages in battleground states. In Nevada, Masto’s campaign reached 32% of voters at their door while just 23% heard from Laxalt’s campaign at the door. In Pennsylvania, voters reported seeing more pro-Fetterman ads than pro-Oz ads by 8%, with Fetterman’s advertising advantage being particularly high in the Scranton DMA and smaller media markets like Erie and Johnstown DMAs. In both these cases, the individual Democratic campaigns were able to leverage their national small dollar donor fundraising advantage into giving them tactical advantages on the ground and in the air that may have made the difference between winning and losing.

Political Environment

We also sought to learn what Republican activists thought about the outcomes of the elections and who they identify as leaders. Specific voter outreach tactics and media strategies can only shift voter sentiment within a certain spectrum. Therefore, understanding the broader political environment is essential to gaining clarity on how voters made their decisions.

Republicans Were Surprised There Was No Red Wave

Given the state of the economy and Joe Biden’s unpopularity, voters in our focus groups expected a different outcome and struggled to accept the election results. The surprising outcome combined with the delay in reporting results fed into unfounded conspiracy theories about stolen elections.

Republicans Are Open To Moving On From Trump

The Republican activists we heard from in focus groups still like Trump, but spoke of the need for “fresh faces” and it being time to move on. Ron DeSantis was most frequently mentioned as the likely successor of Trump’s brand of conservatism as being “strong” and “tough.”

Conclusion

The Center for Campaign Innovation’s post election research offers foundational insights into how voters interact with candidates and political campaigners with new technology, media platforms, and advertising methods, and how campaigns can improve their efforts to better reach these voters and activists where they are.

Methodology

The Center for Campaign Innovation commissioned David Kanevsky with 3D Strategic Research to conduct post-election surveys and focus groups with voters and activists.

A national survey was conducted November 6-10, 2022 with n=1,500 voters. The survey included an oversample of donors, with a total of n=533 donors nationally. The national survey was conducted using a mixed mode of an online panel matched to the Data Trust voter file along with text messages inviting voters to take the survey via a secure web link, while the donor oversample was conducted via e-mail and text message from a random sample of those flagged as recent political donors off the L2 voter file. The margin of error for the national survey is +/- 2.53% and the margin of error for the donor survey is +/- 4.24%

Additionally, a series of post-election surveys was conducted in Nevada, Pennsylvania and battleground Congressional Districts. Those surveys were conducted November 8-10, 2022 with a mix of live calls to landlines and cell phones, text messages inviting voters to take the survey via a secure web link, and respondents recruited from an online panel matched to the Data Trust voter file. The Nevada survey was conducted in both English and Spanish. The Nevada and Pennsylvania surveys were conducted with N=800 voters per state, and the battleground Congressional District survey was conducted in CA-47, IN-01, PA-07, and VA-02 with N=200 voters per district. Each of these surveys has a margin of error of +/- 3.46%

For all surveys, the sample was stratified based on the probability of voting in the November 2022 election. Respondents were matched to the correct individual in the household, based on their gender and age, with party registration, vote history and modeled data pulled from the file for the correct respondent within the household. The final data was weighted to the actual election results and demographics based on the AP/Fox News VoteCast and network exit polls.

The surveys were supplemented with qualitative research conducted among Republican volunteers, donors, and digital activists nationally. Two online focus groups with Republican volunteers and donors were conducted on Thursday, November 10th, and a bulletin board discussion group with Republican digital activists was conducted from November 9th to November 13th. All groups were moderated by David Kanevsky.